Wells Fargo Advantage Funds IRADIST 2012 free printable template

Show details

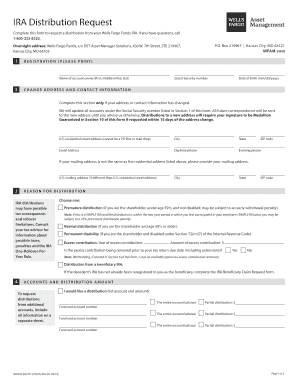

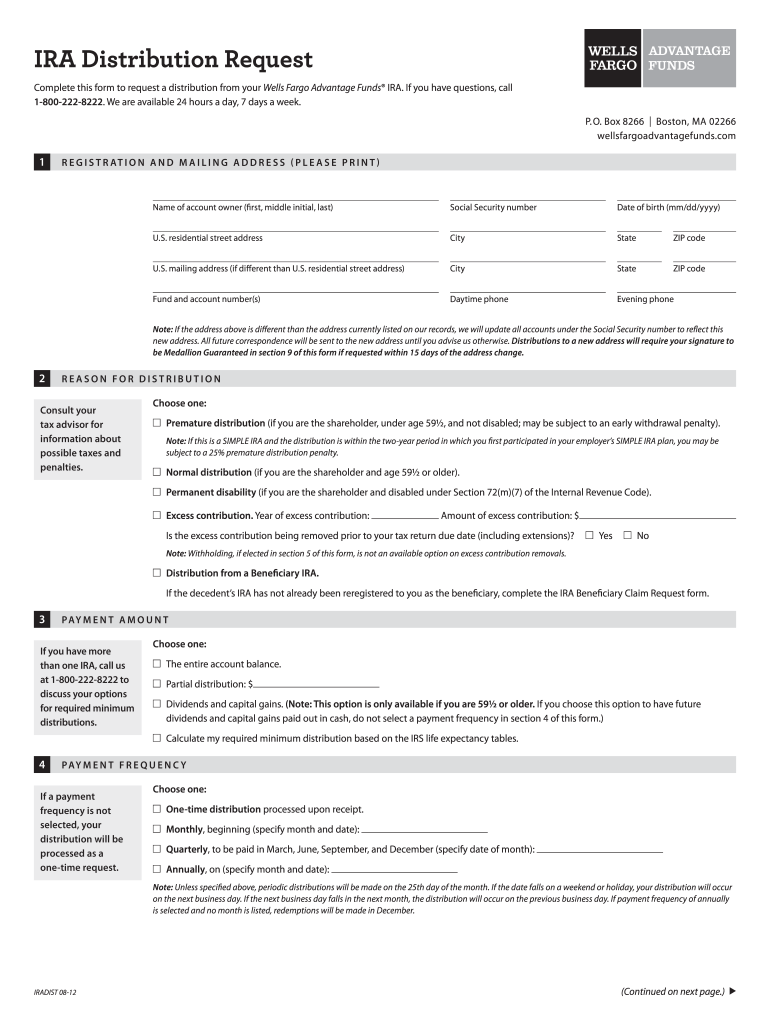

Click here to clear form IRA Distribution Request Complete this form to request a distribution from your Wells Fargo Advantage Funds IRA. If you have questions or would like help completing this form,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Wells Fargo Advantage Funds IRADIST

Edit your Wells Fargo Advantage Funds IRADIST form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Wells Fargo Advantage Funds IRADIST form via URL. You can also download, print, or export forms to your preferred cloud storage service.

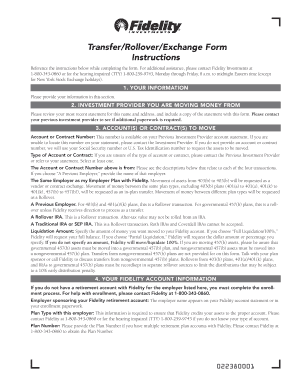

How to edit Wells Fargo Advantage Funds IRADIST online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit Wells Fargo Advantage Funds IRADIST. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Wells Fargo Advantage Funds IRADIST Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Wells Fargo Advantage Funds IRADIST

How to fill out Wells Fargo Advantage Funds IRADIST

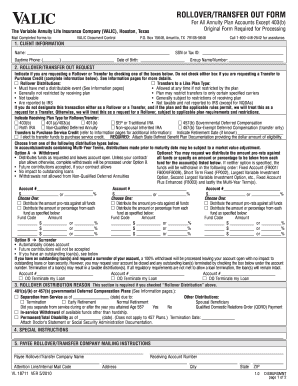

01

Gather necessary documents: Prepare your personal identification, Social Security number, and any related financial information.

02

Access the application: Visit the Wells Fargo website or contact a Wells Fargo representative to obtain the Wells Fargo Advantage Funds IRADIST application.

03

Fill out personal information: Complete the sections that ask for your name, address, date of birth, and other identifying information.

04

Determine your investment strategy: Review the available options and choose how you want to allocate your investments.

05

Specify contribution amounts: Indicate how much you wish to contribute to the account and whether it will be a one-time or ongoing contribution.

06

Review terms and conditions: Read through the investment terms, withdrawal policies, and any associated fees.

07

Sign and date the application: Ensure you provide your signature and the date on the application to confirm your consent.

08

Submit the application: Send the completed application to Wells Fargo either online or through traditional mail.

Who needs Wells Fargo Advantage Funds IRADIST?

01

Individuals looking to save for retirement and wanting tax-deferred investment growth.

02

Clients seeking a diversified investment option within Wells Fargo's offerings.

03

People who need a structured account for managing long-term investment goals.

Instructions and Help about Wells Fargo Advantage Funds IRADIST

Fill

form

: Try Risk Free

People Also Ask about

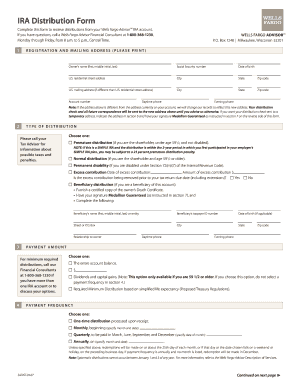

How do I request an IRA distribution?

Regardless of your age, you will need to file a Form 1040 and show the amount of the IRA withdrawal. Since you took the withdrawal before you reached age 59 1/2, unless you met one of the exceptions, you will need to pay an additional 10% tax on early distributions on your Form 1040.

Can I withdraw money from my Wells Fargo IRA?

Taking Distributions You pay no taxes on any investment earnings until you withdraw or “distribute” the money from your account, presumably in retirement. If you make distributions before age 59 1/2, you may owe a 10% additional tax. There are exceptions which allow you to avoid the 10% additional tax: Death.

What is IRA distribution request form?

IRA/ESA Distribution Request Instructions. This form is used to request a reportable distribution of assets from Traditional IRAs, SEP IRAs, SIMPLE IRAs, Roth IRAs, Education Savings Accounts, Inherited IRAs, and Inherited ESAs. •

How do I request a distribution from my Wells Fargo IRA?

You must call us at the numbers indicated below to request a distribution from your IRA — be sure to have your account number(s) handy. Wells Fargo Bank IRA – you can call the Best IRA service team at 1-800-237-8472 to complete reinvestment of a mature CD, Roth IRA conversions, and transfers due to divorce.

What are the distribution rules for Wells Fargo IRA?

Taking Distributions You pay no taxes on any investment earnings until you withdraw or “distribute” the money from your account, presumably in retirement. If you make distributions before age 59 1/2, you may owe a 10% additional tax. There are exceptions which allow you to avoid the 10% additional tax: Death.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit Wells Fargo Advantage Funds IRADIST in Chrome?

Install the pdfFiller Google Chrome Extension to edit Wells Fargo Advantage Funds IRADIST and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I create an electronic signature for signing my Wells Fargo Advantage Funds IRADIST in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your Wells Fargo Advantage Funds IRADIST and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

Can I edit Wells Fargo Advantage Funds IRADIST on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign Wells Fargo Advantage Funds IRADIST right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is Wells Fargo Advantage Funds IRADIST?

Wells Fargo Advantage Funds IRADIST refers to the Individual Retirement Account (IRA) distribution form used by Wells Fargo to report distributions from IRA accounts for tax purposes.

Who is required to file Wells Fargo Advantage Funds IRADIST?

Individuals who have taken distributions from their Wells Fargo Advantage Funds IRA accounts are required to file the Wells Fargo Advantage Funds IRADIST.

How to fill out Wells Fargo Advantage Funds IRADIST?

To fill out the Wells Fargo Advantage Funds IRADIST, individuals need to provide their personal information, account details, distribution amounts, and any taxes withheld.

What is the purpose of Wells Fargo Advantage Funds IRADIST?

The purpose of Wells Fargo Advantage Funds IRADIST is to report the distribution of funds from IRAs to the IRS, ensuring proper tax compliance and record-keeping.

What information must be reported on Wells Fargo Advantage Funds IRADIST?

The information that must be reported includes the account holder's name, account number, distribution amount, type of distribution, and any federal taxes withheld.

Fill out your Wells Fargo Advantage Funds IRADIST online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Wells Fargo Advantage Funds IRADIST is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.